A Prepare dinner County property tax search is a web-based software that permits customers to seek for property tax data for any property in Prepare dinner County, Illinois. The search could be carried out by handle, property index quantity, or proprietor’s title. The outcomes of the search will embody the property’s authorized description, assessed worth, market worth, and present tax invoice.

Property tax searches are necessary for numerous causes. First, they might help property house owners to make sure that they’re paying the right amount of taxes. Second, they might help potential consumers and sellers to analysis properties earlier than making a purchase order or sale. Third, they might help researchers and journalists to trace property values and tendencies.

The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois.

Prepare dinner County Property Tax Search

A Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed here are 10 key features of a Prepare dinner County property tax search:

- Property Deal with: Search by the property’s avenue handle or map quantity.

- Proprietor’s Identify: Search by the title of the property proprietor.

- Property Index Quantity: Search by the property’s distinctive identification quantity.

- Authorized Description: View the authorized description of the property.

- Assessed Worth: Discover the property’s assessed worth, which is used to calculate property taxes.

- Market Worth: View the property’s estimated market worth.

- Present Tax Invoice: View the property’s present tax invoice, together with the quantity of taxes due and the due date.

- Cost Historical past: View the property’s fee historical past, together with the dates and quantities of earlier funds.

- Exemptions: View any exemptions that the property could also be eligible for, such because the house owner’s exemption.

- Tax Gross sales: Seek for properties which were bought for unpaid taxes.

These key features present a complete overview of the knowledge that’s obtainable by way of a Prepare dinner County property tax search. This data can be utilized for a wide range of functions, similar to:

- Making certain that you’re paying the right amount of property taxes.

- Researching properties earlier than shopping for or promoting.

- Monitoring property values and tendencies.

- Discovering out if a property is eligible for any exemptions.

- Researching properties which were bought for unpaid taxes.

Property Deal with

The property handle is a vital piece of knowledge for a Prepare dinner County property tax search. It permits customers to rapidly and simply discover the property they’re concerned with, no matter whether or not they know the property’s index quantity or proprietor’s title.

-

Aspect 1: Comfort and Accessibility

Looking out by property handle is essentially the most handy and accessible solution to carry out a Prepare dinner County property tax search. Customers can merely enter the property’s avenue handle or map quantity into the search bar and click on “search.” That is particularly useful for customers who have no idea the property’s index quantity or proprietor’s title.

-

Aspect 2: Accuracy and Precision

Looking out by property handle can also be a really correct and exact solution to discover the proper property. It’s because the property handle is a singular identifier for every property in Prepare dinner County. This helps to make sure that customers will discover the proper property, even when there are a number of properties with related names or house owners.

-

Aspect 3: Complete Outcomes

Looking out by property handle returns essentially the most complete outcomes. It’s because the search outcomes will embody the entire data that’s obtainable for the property, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

-

Aspect 4: Time-Saving

Looking out by property handle can save customers quite a lot of time. It’s because customers wouldn’t have to spend time looking for the property’s index quantity or proprietor’s title. This may be particularly useful for customers who’re researching a number of properties.

General, looking by property handle is essentially the most handy, accessible, correct, exact, complete, and time-saving solution to carry out a Prepare dinner County property tax search.

Proprietor’s Identify

Trying to find property tax data by proprietor’s title is a useful function of the Prepare dinner County property tax search software. It permits customers to rapidly and simply discover properties owned by a specific particular person or entity, whatever the property’s handle or index quantity.

This function is especially helpful for a number of causes. First, it might probably assist customers to trace down properties which can be owned by a specific particular person or entity, even when they have no idea the property’s handle or index quantity. This may be useful for a wide range of functions, similar to:

- Investigating potential conflicts of curiosity.

- Monitoring the possession historical past of a specific property.

- Discovering out who owns a vacant or deserted property.

Second, looking by proprietor’s title might help customers to determine properties which can be owned by a number of people or entities. This data could be useful for a wide range of functions, similar to:

- Figuring out the possession construction of a specific property.

- Discovering out who’s chargeable for paying the property taxes.

- Figuring out potential heirs to a property.

General, trying to find property tax data by proprietor’s title is a useful software for anybody who must analysis property possession data in Prepare dinner County, Illinois.

Property Index Quantity

The Property Index Quantity (PIN) is a singular identification quantity assigned to every property in Prepare dinner County, Illinois. It’s a 14-digit quantity that’s used to determine the property for tax functions. The PIN can also be used to trace the property’s possession and evaluation historical past.

-

Aspect 1: Significance of the PIN

The PIN is a crucial piece of knowledge for a Prepare dinner County property tax search. It permits customers to rapidly and simply discover the property they’re concerned with, even when they have no idea the property’s handle or proprietor’s title.

-

Aspect 2: The place to Discover the PIN

The PIN could be discovered on the property’s tax invoice or on the Prepare dinner County Assessor’s web site. It may also be obtained by calling the Prepare dinner County Assessor’s workplace.

-

Aspect 3: Utilizing the PIN to Seek for Property Tax Info

Upon getting the PIN, you should utilize it to seek for property tax data on the Prepare dinner County Assessor’s web site. The search outcomes will embody the entire data that’s obtainable for the property, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

-

Aspect 4: Advantages of Utilizing the PIN

Utilizing the PIN to seek for property tax data has a number of advantages. First, it’s a fast and simple solution to discover the knowledge you want. Second, it’s a very correct solution to discover the proper property, even when there are a number of properties with related names or house owners. Third, it’s a complete solution to discover the entire data that’s obtainable for the property.

General, the PIN is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois.

Authorized Description

The authorized description is an in depth description of the property’s boundaries and site. It is necessary as a result of it supplies a transparent and unambiguous solution to determine the property and distinguish it from different properties. The authorized description can also be used to calculate the property’s assessed worth and tax invoice.

The authorized description is a part of the Prepare dinner County property tax search as a result of it’s essential to determine the property and decide its assessed worth and tax invoice. With out the authorized description, it might be tough to make sure that the property is being taxed accurately.

Right here is an instance of a authorized description:

LOT 12 IN THE SUBDIVISION OF THE WEST 1/2 OF THE SOUTHEAST 1/4 OF SECTION 21, TOWNSHIP 42 NORTH, RANGE 13, EAST OF THE THIRD PRINCIPAL MERIDIAN, IN COOK COUNTY, ILLINOIS.

This authorized description identifies the property as Lot 12 in a subdivision of a bigger parcel of land. The bigger parcel of land is positioned within the West 1/2 of the Southeast 1/4 of Part 21, Township 42 North, Vary 13, East of the Third Principal Meridian, in Prepare dinner County, Illinois.

Authorized descriptions could be complicated and obscure. Nevertheless, they’re an necessary a part of the property tax evaluation and assortment course of. By understanding the authorized description of a property, taxpayers can make sure that they’re paying the right amount of taxes.

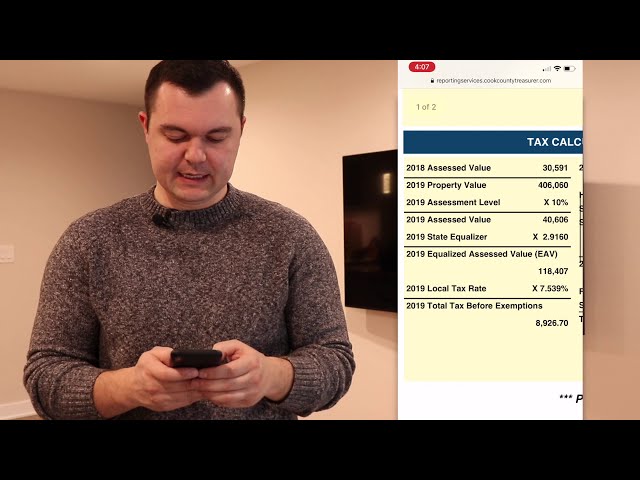

Assessed Worth

Within the context of a Prepare dinner County property tax search, the assessed worth of a property is a vital piece of knowledge. It serves as the inspiration for calculating the property’s tax invoice and performs a big position in figuring out the quantity of taxes owed by the property proprietor.

-

Aspect 1: Understanding Assessed Worth

Assessed worth represents the estimated market worth of a property as decided by the county assessor. It’s sometimes decrease than the property’s precise market worth, contemplating components such because the property’s age, situation, and site. Understanding the assessed worth helps property house owners assess the accuracy of their tax invoice and determine potential discrepancies.

-

Aspect 2: Position in Property Tax Calculation

The assessed worth varieties the idea for calculating property taxes. Prepare dinner County determines the tax charge every year, which is then utilized to the assessed worth to find out the quantity of taxes due. Property house owners can use this data to estimate their annual property tax legal responsibility.

-

Aspect 3: Implications for Property Homeowners

The assessed worth has vital implications for property house owners. The next assessed worth may end up in increased property taxes, doubtlessly impacting the proprietor’s monetary state of affairs. Conversely, a decrease assessed worth can result in decrease tax payments, offering monetary reduction to the proprietor.

-

Aspect 4: Contesting Assessed Worth

Property house owners have the best to contest the assessed worth of their property in the event that they consider it’s inaccurate. By submitting an attraction with the county assessor, property house owners can present proof to assist a decrease assessed worth, doubtlessly decreasing their property tax burden.

The assessed worth of a property is a crucial part of the Prepare dinner County property tax search. By understanding the assessed worth, property house owners could make knowledgeable choices relating to their property taxes, making certain equity and accuracy within the property tax evaluation and assortment course of.

Market Worth

Throughout the context of a Prepare dinner County property tax search, understanding the market worth of a property holds nice significance. It performs a vital position in figuring out the property’s assessed worth, which varieties the idea for calculating property taxes.

Market worth represents the estimated value a property would fetch in a aggressive actual property market. It considers components such because the property’s location, dimension, situation, and up to date comparable gross sales within the space. By offering an estimate of the property’s price, the market worth assists in making certain honest and correct property tax assessments.

The Prepare dinner County property tax search incorporates market worth as a key part. It permits property house owners to entry this data, permitting them to check it with the assessed worth and determine any potential discrepancies. This empowers them to make knowledgeable choices relating to their property taxes and contest the assessed worth if essential.

For example, if a property proprietor believes that the assessed worth is increased than the precise market worth, they’ll file an attraction with proof supporting their declare. By presenting comparable gross sales information or latest value determinations, they’ll reveal the property’s true price and doubtlessly safe a decrease assessed worth, resulting in diminished property taxes.

Understanding the connection between market worth and Prepare dinner County property tax search empowers property house owners to actively take part within the property tax evaluation course of. It supplies them with a useful software to make sure correct tax assessments and safeguard their monetary pursuits.

Present Tax Invoice

The “Present Tax Invoice” part holds vital significance inside the context of a Prepare dinner County property tax search. It supplies property house owners with essential data relating to their property’s tax legal responsibility and the related due date for fee. Understanding this part empowers property house owners to satisfy their tax obligations precisely and on time.

-

Aspect 1: Entry to Cost Info

The “Present Tax Invoice” supplies property house owners with complete particulars about their present tax invoice. This contains the entire quantity of taxes due, the breakdown of various tax elements (e.g., county tax, college tax, and many others.), and any relevant late charges or penalties. This data is essential for budgeting and making certain well timed funds, avoiding potential penalties similar to tax liens or foreclosures.

-

Aspect 2: Cost Due Dates

The “Present Tax Invoice” clearly shows the due date for property tax funds. Property house owners should adhere to those deadlines to keep away from penalties and preserve an excellent fee historical past. The Prepare dinner County property tax search permits property house owners to simply entry this data, enabling them to plan their funds accordingly and stop any potential disruptions of their monetary obligations.

-

Aspect 3: Dispute Decision

If property house owners have any issues or disputes relating to their tax invoice, the “Present Tax Invoice” supplies useful data. It permits them to determine the suitable contact individual or division inside the Prepare dinner County authorities for resolving these points. This facilitates well timed communication and helps property house owners navigate the method of addressing any discrepancies or errors of their tax evaluation.

In abstract, the “Present Tax Invoice” part of the Prepare dinner County property tax search is a necessary software for property house owners. It supplies them with the mandatory data to grasp their tax legal responsibility, meet fee deadlines, and resolve any potential points. By leveraging this part, property house owners can make sure that they fulfill their tax obligations precisely and preserve a transparent understanding of their property’s tax standing.

Cost Historical past

The “Cost Historical past” part inside the Prepare dinner County property tax search software supplies essential insights right into a property’s tax fee file. It serves as a useful useful resource for property house owners, potential consumers, and researchers, providing a complete view of previous funds and serving to to evaluate the property’s monetary historical past.

-

Aspect 1: Verifying Cost Information

The “Cost Historical past” permits property house owners to confirm their fee data, making certain that every one funds have been made on time and within the appropriate quantities. This data is especially helpful for properties with complicated possession constructions or people who have lately modified palms, because it supplies a transparent and simply accessible file of previous funds.

-

Aspect 2: Figuring out Potential Points

By reviewing the “Cost Historical past,” potential consumers can determine any potential points associated to the property’s tax standing. For example, a historical past of late funds or excellent balances might point out monetary misery or different underlying issues that would have an effect on the property’s worth or desirability.

-

Aspect 3: Researching Property Developments

Researchers and analysts can make the most of the “Cost Historical past” to trace property tax fee tendencies over time. This data can present insights into the monetary well being of a specific neighborhood or area, in addition to determine patterns in property tax assortment and enforcement.

In conclusion, the “Cost Historical past” part of the Prepare dinner County property tax search software is a useful useful resource for property house owners, potential consumers, and researchers alike. It supplies an in depth and simply accessible file of previous funds, serving to to make sure accuracy, determine potential points, and achieve insights into property tax tendencies.

Exemptions

The “Exemptions” part of the Prepare dinner County property tax search software performs a vital position in figuring out and understanding the varied exemptions which will apply to a property, doubtlessly decreasing the general tax burden for eligible property house owners.

Exemptions are deductions or reductions utilized to the assessed worth of a property, leading to decrease property taxes. The Prepare dinner County property tax search permits property house owners to simply decide in the event that they qualify for any exemptions, such because the house owner’s exemption, which supplies a big discount in taxes for owner-occupied properties.

Understanding the supply and eligibility standards for exemptions is crucial for property house owners to optimize their tax financial savings. The Prepare dinner County property tax search software supplies a complete record of accessible exemptions, together with detailed data on the necessities and utility course of. This empowers property house owners to make knowledgeable choices and make the most of any relevant exemptions, making certain honest and equitable property tax assessments.

For example, senior residents and disabled people might qualify for added exemptions, additional decreasing their property tax legal responsibility. By leveraging the “Exemptions” part of the Prepare dinner County property tax search, these people can determine and apply for the suitable exemptions, offering much-needed monetary reduction.

In conclusion, the “Exemptions” part of the Prepare dinner County property tax search is an indispensable software for property house owners to discover and perceive the varied exemptions which will apply to their property. It empowers them to cut back their tax burden, optimize their monetary state of affairs, and guarantee correct and honest property tax assessments.

Tax Gross sales

Throughout the context of a Prepare dinner County property tax search, the part specializing in “Tax Gross sales” holds vital significance. It permits customers to seek for properties which were bought for unpaid taxes, offering useful insights into the property’s monetary historical past and potential funding alternatives.

Unpaid property taxes can result in tax liens and finally consequence within the property being bought at a tax sale. By trying to find tax gross sales, potential consumers can determine properties which can be obtainable for buy at a reduced value. This data is especially helpful for traders looking for undervalued properties or people in search of inexpensive housing choices.

The Prepare dinner County property tax search software supplies detailed data on tax gross sales, together with the property’s handle, authorized description, assessed worth, and the quantity of unpaid taxes. This data empowers customers to make knowledgeable choices about potential property purchases and navigate the tax sale course of successfully.

For example, an investor researching potential funding properties might use the tax gross sales part to determine distressed properties with excessive potential returns. By analyzing the unpaid tax quantities and property values, they’ll assess the viability of investing in these properties and make strategic choices.

In abstract, the “Tax Gross sales” part of the Prepare dinner County property tax search is a necessary software for traders, potential homebuyers, and researchers looking for data on properties bought for unpaid taxes. It supplies useful insights into property possession historical past, monetary misery, and funding alternatives, enabling customers to make knowledgeable choices and navigate the tax sale course of successfully.

Making certain that you’re paying the right amount of property taxes.

Within the context of property possession and monetary obligations, making certain that you’re paying the right amount of property taxes is of paramount significance. The Prepare dinner County property tax search software performs a significant position in facilitating this course of by offering complete data and assets.

-

Aspect 1: Correct Property Evaluation

A vital side of making certain appropriate property tax funds lies in correct property evaluation. The Prepare dinner County property tax search software permits property house owners to entry particulars about their property’s assessed worth, which varieties the idea for tax calculations. By reviewing this data, property house owners can determine any discrepancies or errors within the evaluation, making certain that their tax legal responsibility is honest and proportionate.

-

Aspect 2: Eligibility for Exemptions and Reductions

Many property house owners could also be eligible for exemptions or reductions of their property taxes. The Prepare dinner County property tax search software supplies data on numerous exemption packages, such because the house owner’s exemption or senior citizen exemptions. By exploring these choices, property house owners can doubtlessly decrease their tax burden and optimize their monetary state of affairs.

-

Aspect 3: Cost Historical past and Delinquencies

The Prepare dinner County property tax search software provides insights right into a property’s fee historical past, together with any excellent balances or delinquencies. This data is crucial for property house owners to keep away from penalties and potential authorized penalties. By staying knowledgeable about their fee standing, property house owners can take proactive steps to satisfy their tax obligations and preserve a transparent monetary file.

-

Aspect 4: Analysis and Due Diligence

For potential property consumers or traders, the Prepare dinner County property tax search software serves as a useful useful resource for due diligence. By researching the property tax historical past of a possible buy, consumers can achieve insights into the property’s monetary obligations and make knowledgeable choices. This data might help keep away from surprises or surprising monetary burdens sooner or later.

In conclusion, the Prepare dinner County property tax search software is an indispensable useful resource for property house owners, potential consumers, and traders looking for to make sure that they’re paying the right amount of property taxes. By leveraging the knowledge and assets offered by the software, property house owners can fulfill their monetary obligations precisely, optimize their tax legal responsibility, and make knowledgeable choices associated to their property.

Researching properties earlier than shopping for or promoting.

Conducting thorough analysis on properties earlier than making a purchase order or sale resolution is a vital step in actual property transactions. The Prepare dinner County property tax search software performs a big position on this course of by offering useful data that may empower people to make knowledgeable choices.

Understanding property tax implications is crucial for consumers and sellers alike. The Prepare dinner County property tax search software permits customers to entry detailed details about a property’s tax historical past, together with present and previous tax payments, exemptions, and any excellent liens or delinquencies. By reviewing this data, potential consumers can assess the continuing monetary obligations related to the property and issue these prices into their buying choices.

Equally, sellers can make the most of the Prepare dinner County property tax search software to make sure that they’re assembly their tax obligations and to offer correct data to potential consumers. A transparent and up-to-date tax historical past can improve the property’s marketability and instill confidence in consumers.

Researching property taxes additionally helps people keep away from potential authorized problems and monetary pitfalls. Unpaid property taxes can result in penalties, liens, and even foreclosures. Through the use of the Prepare dinner County property tax search software, people can keep knowledgeable about their tax standing and take proactive steps to keep away from any adversarial penalties.

In conclusion, researching properties earlier than shopping for or promoting is a crucial part of actual property transactions. The Prepare dinner County property tax search software is a necessary useful resource that empowers people to make knowledgeable choices by offering complete details about a property’s tax historical past and obligations.

Monitoring property values and tendencies

Monitoring property values and tendencies is a vital side of actual property investing, market evaluation, and knowledgeable decision-making for householders and potential consumers. The Prepare dinner County property tax search software performs a big position on this course of by offering useful information and insights.

-

Aspect 1: Monitoring Market Situations

The Prepare dinner County property tax search software permits customers to trace property values over time, offering insights into market tendencies and fluctuations. By analyzing historic tax information, traders and householders can determine areas with rising or declining property values, serving to them make knowledgeable funding choices and assess the potential return on their investments.

-

Aspect 2: Comparative Evaluation

The Prepare dinner County property tax search software permits customers to check property values inside neighborhoods, college districts, and totally different geographical areas. This comparative evaluation helps traders and householders perceive the relative worth of properties, determine undervalued or overpriced properties, and make knowledgeable choices about potential purchases or gross sales.

-

Aspect 3: Assessing Lengthy-Time period Developments

The Prepare dinner County property tax search software supplies entry to historic tax information, permitting customers to trace property values over prolonged intervals. This long-term evaluation helps traders and householders determine rising tendencies, similar to gentrification or financial decline, which might affect property values and funding methods.

-

Aspect 4: Informing Funding Selections

Actual property traders depend on property worth tendencies to make knowledgeable funding choices. The Prepare dinner County property tax search software supplies useful information on property values, tax charges, and historic tendencies, empowering traders to conduct thorough due diligence and determine potential funding alternatives with increased returns.

In conclusion, the Prepare dinner County property tax search software is a useful useful resource for monitoring property values and tendencies. By offering complete information and insights, this software permits householders, potential consumers, and traders to make knowledgeable choices, assess market situations, and determine funding alternatives.

Discovering out if a property is eligible for any exemptions.

Within the realm of property tax assessments and funds, understanding the eligibility of a property for exemptions holds vital significance. The Prepare dinner County property tax search software supplies a complete platform for property house owners to determine whether or not their property qualifies for any exemptions that may doubtlessly cut back their tax legal responsibility.

-

Aspect 1: House owner’s Exemption

One of the frequent exemptions is the house owner’s exemption, which grants a discount within the assessed worth of owner-occupied residential properties. By looking by way of the Prepare dinner County property tax search software, householders can decide in the event that they meet the eligibility standards and apply for this exemption, resulting in potential tax financial savings.

-

Aspect 2: Senior Citizen Exemptions

Prepare dinner County provides exemptions tailor-made to senior residents who meet particular age and revenue necessities. These exemptions can present substantial property tax reduction, easing the monetary burden on aged householders. The property tax search software permits seniors to discover their eligibility and apply for these exemptions.

-

Aspect 3: Incapacity Exemptions

Property house owners with disabilities may additionally qualify for exemptions that cut back their property tax legal responsibility. The Prepare dinner County property tax search software supplies data on the eligibility standards and utility course of for incapacity exemptions, serving to people with disabilities entry these advantages.

-

Aspect 4: Veterans’ Exemptions

Prepare dinner County acknowledges the service of veterans by way of property tax exemptions. Veterans who meet sure standards, similar to size of service and incapacity standing, can apply for exemptions that may considerably cut back their property tax burden. The property tax search software assists veterans in figuring out their eligibility and making use of for these exemptions.

By leveraging the Prepare dinner County property tax search software, property house owners can proactively determine and apply for exemptions that may decrease their tax legal responsibility. These exemptions not solely present monetary reduction but additionally reveal the county’s dedication to supporting householders, senior residents, people with disabilities, and veterans.

Researching properties which were bought for unpaid taxes.

Throughout the complete framework of the Prepare dinner County property tax search, researching properties which were bought for unpaid taxes holds immense significance. This side of the search software empowers people to achieve useful insights into the property’s monetary historical past and potential funding alternatives.

Understanding the method of tax gross sales is essential. When property taxes stay unpaid, the county might place a tax lien on the property. If the taxes and related charges usually are not settled inside a specified interval, the property could also be bought at a tax sale. The Prepare dinner County property tax search software supplies entry to data on properties which have gone by way of this course of.

For traders, researching tax gross sales can result in the identification of undervalued properties that may be acquired at a reduced value. By analyzing the unpaid tax quantities, property values, and different related particulars, traders could make knowledgeable choices about potential investments. This data may also be useful for people looking for inexpensive housing choices.

Moreover, researching properties which were bought for unpaid taxes can present insights right into a neighborhood’s monetary well being and stability. Areas with a excessive variety of tax gross sales might point out financial misery, whereas a low variety of tax gross sales might recommend a extra secure actual property market.

In conclusion, researching properties which were bought for unpaid taxes is an integral part of the Prepare dinner County property tax search software. It empowers people to make knowledgeable funding choices, achieve insights right into a neighborhood’s monetary well being, and determine potential alternatives for buying undervalued properties.

Often Requested Questions on Prepare dinner County Property Tax Search

The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed here are some steadily requested questions in regards to the search software:

Query 1: What data can I discover utilizing the Prepare dinner County property tax search?

Reply: You will discover a wide range of data utilizing the Prepare dinner County property tax search, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

Query 2: How do I seek for a property utilizing the Prepare dinner County property tax search?

Reply: You may seek for a property utilizing the Prepare dinner County property tax search by handle, property index quantity, or proprietor’s title.

Query 3: What’s the distinction between assessed worth and market worth?

Reply: Assessed worth is the worth that the county assessor determines the property to be price for tax functions. Market worth is the estimated value that the property would promote for on the open market.

Query 4: What are exemptions?

Reply: Exemptions are deductions or reductions that may be utilized to the assessed worth of a property, leading to decrease property taxes. Frequent exemptions embody the house owner’s exemption and the senior citizen exemption.

Query 5: What’s a tax sale?

Reply: A tax sale is a sale of a property that has been bought for unpaid taxes. Properties which can be bought at tax gross sales are sometimes bought at a reduced value.

Query 6: How can I discover out if a property is eligible for an exemption?

Reply: You will discover out if a property is eligible for an exemption by contacting the Prepare dinner County Assessor’s workplace.

These are only a few of the steadily requested questions in regards to the Prepare dinner County property tax search. For extra data, please go to the Prepare dinner County Assessor’s web site.

Abstract: The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. The search software is simple to make use of and supplies a wealth of details about properties in Prepare dinner County.

Transition to the subsequent article part: If you’re concerned with studying extra about property taxes in Prepare dinner County, please proceed studying the next article.

Suggestions for Utilizing the Prepare dinner County Property Tax Search

The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed here are 5 ideas for utilizing the search software:

Tip 1: Use the proper search standards.

The Prepare dinner County property tax search lets you seek for properties by handle, property index quantity, or proprietor’s title. Be certain that to make use of the proper search standards to make sure that you discover the proper property.Tip 2: Evaluate the entire data that’s obtainable.

The Prepare dinner County property tax search supplies a wealth of details about properties in Prepare dinner County, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past. Be sure you overview the entire data that’s obtainable to get a whole image of the property.Tip 3: Contact the Prepare dinner County Assessor’s workplace if in case you have any questions.

When you have any questions in regards to the Prepare dinner County property tax search or about property taxes typically, please contact the Prepare dinner County Assessor’s workplace. The Assessor’s workplace could be reached by telephone at (312) 443-7550 or by electronic mail at assessorinfo@cookcountyil.gov.Tip 4: Pay attention to the deadlines for paying your property taxes.

Property taxes in Prepare dinner County are due in two installments: the primary installment is due on March 1st and the second installment is due on August 1st. There’s a 10-day grace interval after every due date, however curiosity might be charged on any unpaid taxes after the grace interval has expired.Tip 5: Reap the benefits of the exemptions that you’re eligible for.

There are a variety of exemptions that may be utilized to the assessed worth of a property, leading to decrease property taxes. Frequent exemptions embody the house owner’s exemption and the senior citizen exemption. To seek out out if you’re eligible for an exemption, please contact the Prepare dinner County Assessor’s workplace.

By following the following tips, you possibly can benefit from the Prepare dinner County property tax search and guarantee that you’re paying the right amount of property taxes.

Abstract: The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. By following the ideas above, you should utilize the search software to seek out the knowledge you want and guarantee that you’re paying the right amount of property taxes.

Conclusion

The Prepare dinner County property tax search is a useful software for anybody who must analysis property tax data in Prepare dinner County, Illinois. The search software is simple to make use of and supplies a wealth of details about properties in Prepare dinner County, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

Through the use of the Prepare dinner County property tax search, you possibly can guarantee that you’re paying the right amount of property taxes and that you’re making the most of the entire exemptions that you’re eligible for. It’s also possible to use the search software to analysis properties that you’re concerned with shopping for or promoting, or to trace property values and tendencies in your neighborhood.

Youtube Video: